Surprising math on Obamacare levels: Go for the Bronze!

Recently I learned from health.net, the insurer which did my individual plan, that they were canceling it. I'm one of those who lost his health plan with the switch to the ACA (Obamacare) plans, so I need to shop in the healthcare marketplace and will likely end up paying more.

What surprised me when I went to the marketplace was the math of the plans. For those who don't know, there are 4 main classes of plans (Bronze, Silver, Gold, Platinum) which are roughly the same for all insurers. There is also a 5th, "Catastrophic" plan available to under-30s and hardship cases, which is cheaper and covers even less than Bronze. Low income people get a great subsidized price in the marketplace, but people with decent incomes get no subsidy.

The 4 plans are designed so that for the average patient, they will end up paying 60% (Bronze), 70% (Silver), 80% (Gold) or 90% (Platinum) of health care costs, with the patient, on average, bearing the rest. All plans come with a "Maximum out of pocket" (MOOP) that is at most $6,350 for all plans but $4,000 (or less) for the Platinum.

Here's some analysis based on California prices and plans. The other states can vary a fair bit. Insurance is much cheaper in some regions, and there are plans that use moderately different formulae. In every state the MOOP is no more than $6,350 and the actuarial percentages are the same.

As you might expect, the Platinum costs a lot more than the Bronze. But at my age, in my early 50s, I was surprised how much more. I decided to plug in numbers for Blue Cross, which is actually slightly cheaper than many of the other plans. I actually have little information with which to compare the companies. This is quite odd -- my health insurance is going to be by biggest annual expenditure after my mortgage. More than my car -- but there's tons of information to help you choose a car. (Consumer Reports does have a comparison article on the major insurance companies before the ACA for their subscribers.)

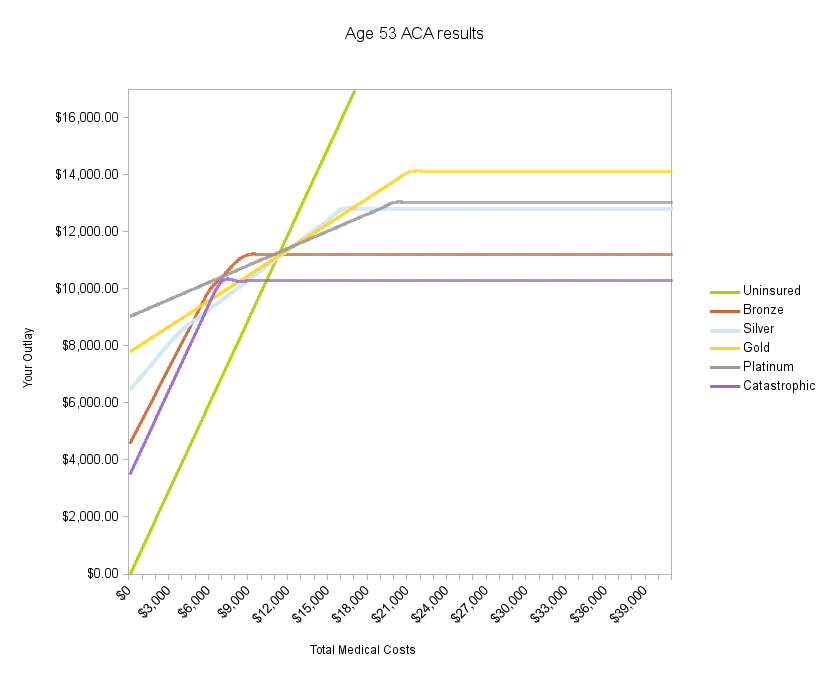

The Platinum plan costs $350/month extra over Bronze, $4200/year. Almost as much as the MOOP. So I decided to build a spreadsheet that would show me what I would end up paying on each plan in total -- premiums plus my personal outlays. Here is the sheet for me in my early 50s:

The X axis is how much your health care actually cost, ie. what your providers were paid. The Y axis is how much you had to pay. The green line is unity, with your payout equal to the cost, as might happen in theory if you were uninsured. In theory, because in reality uninsured people pay a "list price" that is several times the cost that insurance companies negotiate. Also in theory because those uninsured must pay a tax penalty.

All the plans go up at one rate until they first hit your deductibles (Bronze/Silver) and then at a slower rate until you hit your MOOP. After the MOOP they are a flat line almost no matter what your health spending does. The Silver plan is the most complex. It has a $250 drug deductible and a $2000 general deductible and the usual $6,350 MOOP. In reality, these slopes will not be smooth lines. For example, on the silver plan if you are mostly doing doctor visits and labs, you do copays, not the deductible. If you hit something else, like MRI scans or hospitalization, you pay out the full cost until you hit the deductible. So each person's slope will be different, but these slopes are meant to represent an estimate for average patients.

The surprising thing about this chart is that the Bronze plan is pretty clearly superior. Only for a small region of costs does your outlay exceed the other plans, and never by much. However, in the most likely region for most people (modest health care) or the danger zone (lots of health care) it is quite a bit cheaper. The catastrophic plan, if you can get your hands on it over 30, is even better. It almost never does worse than the other plans.

I will note that the zone where Bronze is not the winner is around the $8,400 average cost of health care in the USA. However, what I really want to learn is the median cost, a statistic that is not readily available, or even better the median cost or distribution of costs at each age cohort. The actuaries obviously know this, and I would like pointers to a source.

Premiums are tax deductible for the self-employed, as are large medical expenses for all, but the outlays above premiums can also come from a Health Savings Account (HSA) which is a special IRA-like instrument. You put in up to around $3K each year tax-free, and can pay the costs above from it. (You also don't pay tax on appreciation of the account, and can draw out the money post-retirement at a decent rate.) If you are self-employed, depending on your tax bracket, this can seriously alter the chart and push you to a more expensive plan, because the premium money comes from pre-tax dollars and the health expenses don't, unless they are more than 10% of your total income.

The chart suggests the Bronze plan is the clear winner unless you know you will be in the $6K to $10K zone where it's a modest loser. It seems to beat the Platinum all the time (at least in this simplified model) but might have minor competition from the Silver. The Gold is essentially always worse than the Silver.

If we move to age 60, now the win for Bronze is very clear. At age 60, the $5500 extra premium for Platinum almost exceeds the MOOP on the Bronze -- the Bronze will always be cheaper. This makes no sense, and seems to be a result of the fact that the MOOP remains the same no matter how old you are (and is also the same for B/S/G/Cat.) Perhaps varying deductibles and the MOOP over time would have made more variety.

Here the Gold is clearly a loser to the Silver if you were thinking about it. Nobody in this age group should buy the Gold plan but I doubt the sites will say that. Platinum is almost as clearly a loss.

Thinking about money every time you use health care

With the choice for the older person so obvious, this opens up another question, namely one of psychology. The rational thing to do is to buy the Bronze plan. But with its $5,000 deductible, you will find yourself paying out of pocket for almost all your health care except in years you need major treatments and hospitalizations. This is very hard. You might go to the doctor with a sore ankle. "Let's do an MRI, just to see what we see," she says. This costs you a copay or perhaps nothing on an HMO. But consider the Bronze alternative: "By the way, that will cost you $800." Out of your pocket. All the exploration, the fancy drugs, the labs, coming out of your pocket. All the doctor visits after the first 3 (which are included) come from your pocket. Will you say to yourself, "I don't really feel that bad, do I want to spend $160 to ask the doctor about it?" If you bought the fancy plan with the $10 or $20 copay, you usually will ask. Should you do the $300 urgent care visit or wait 2 days to see if you can see your doctor on Monday for $150?" It seems without question that most people will moderately compromise their health if on this plan, even though the math says it's the cheaper choice even if you spend like crazy and do everything the doctors suggest.

As you get younger it gets more complex

I was surprised that the math on the plans, if not the psychology, gave such a clear result. I had presumed a different answer. I presumed the numbers would say, "Listen, if you are in great health, take the cheap plan. If you know you're going to the doctor a lot, take the higher end one." But if they really did say this, it would screw the insurance companies because most people can predict their pattern at the doctor. The big change of the ACA -- same price insurance for people with pre-existing conditions -- would be devastating to the insurers, with all the sick people taking premium plans and the healthy taking cheap plans, and people who learn about a chronic condition switching from cheap to expensive. But it's not nearly so clear.

Here are the sheets for some younger age groups. We can see at 45 that it's already a bit more complex:

Here we start to see some merit to the Platinum for those with pre-existing conditions.

Looking at a 30 year old, things have reversed. Silver seems the loser, though Bronze always wins if you are generally in good health. Platinum shows stronger attraction and Gold seems of limited merit.

25 year olds can also be covered on their parent's plans -- that's another big ACA change -- though they soon must get their own coverage.

It's much harder to tell here, though most 25 year olds are healthy and almost never go to the doctor and thus will retain the attraction of bronze or catastrophic.

The assumptions

The real chart is complex because all sorts of things have different billings. Outside the Bronze/Catastrophic plans, you use copays for doctor visits, x-rays, drugs and bloodwork, as well as ER visits. Hospitalization has a co-insurance, so you pay from 10% (Platinum) to 30% (Bronze) of hospitalizations and fancy services.

To smooth this out, I've assumed that until you hit your deductible, you are paying (either directly, or via co-pays) a certain percentage of the cost. That percentage I estimated (quite roughly) as 55% on Silver and 90% on Bronze. There is no deductible on Gold/Platinum.

From there up to your MOOP, I estimated insurance was paying 80% on platinum, 70% Silver, 65% Gold and 50% on Bronze, but only 5% on Catastrophic. Those numbers are just a bit below the total actuarial number of what a plan is supposed to pay the average patient. Each patient will be different. If you are doing mostly hospitalizations, the plan will be paying 70%, not 50%, for example.

That's why on the Silver and Bronze plots you see two kinks in the line -- one when the deductible is hit, the other when the MOOP is hit. I did not do much to account for the $250 drug deductible on the Silver plan. Truth is, if you get more than a couple of brand-name prescriptions a year, you will probably hit it and switch to the copays. Copays are all over the map. The $19 generic copay on all but the platinum plan may even exceed the negotiated cost of some generic drugs!

Variations in plans

Note these costs were for Blue Cross in Santa Clara County, California. There are a few other variations around with slightly different deductibles on the Bronze and built in HSAs. I did not include those.

The plans vary more from state to state. The main constant is the "actuarial goal" that says that averaged over all customers, the Bronze plan pays 60% of your costs and the Platinum plan 90%, and so on. The $6,350 MOOP is also standard nationwide as a cap, though some premium plans reduce it. However, in other states you will find Bronze plans with only a $3K deductible (NY) and Silver plans with a $3K deductible (RI) and even Platinum plans with higher deductibles, though the average is $350. (The average Platinum MOOP is also just $1850 nationwide, much lower than California's.)

You need to build your own sheet if you want to really examine a different state. You also need to do this if you are getting the subsidy/tax-credit for low income. With this subsidy, the higher end plans can become a real steal, at taxpayer expense.

Two person plans -- never

My analysis of 2 person family plans showed they are never a good idea. You should only take a family plan if you have a child to add as well. The reason is that the costs of the plans are summed, but so do the deductibles and MOOPs! So if you have two people, and one is healthy and the other hits the deductible or MOOP limits, you will pay a lot more.

Why is it so hard to shop for health care?

Why did I have to build this spreadsheet myself? With millions of people getting insurance outside the workplace, and spending $6,000 to $12,000 on health care per year, there should be a vibrant market of information. But I found very little.

It's also like pulling teeth to find out what you will actually pay for things if you choose the (financially wiser) high deductible plan. You get reports from your provider after things happen sometimes, and you learn the crazy immense difference between the "official rate" for a procedure and the "allowed rate" negotiated by the insurance companies. With Bronze, you will be paying that allowed rate, but good luck finding out what it is, because it's different for every insurance company and every medical firm. It used to be easier to shop online for drugs and find out the real consumer rate for them.

There should be a sheet where these numbers are found, and customers can go and say:

I see the doctor about 5 times a year, visit 2 specialists, have 1 x-ray and 3 bloodworks in a typical year. About every 3 years I get an MRI and every 10 years I have something serious like an ER visit or surgery. What will I end up paying under the different plans?

This should exist, but as everybody knows now, the roll-out of the marketplace was not the finest example of online site-building.

While nobody can be dead sure what they will use, and there's a big difference between one lab test and another and one hospitalization and another, right now we have almost nothing to go on except these averaged actuarial percentages. Those are hard to work from because a lot of the cost if from the most sick people, who all go far beyond their MOOP, raising the average for everybody. Just a single surgery can easily go past the MOOP on the lower plans.

Of course, when I lived in Canada it was vastly simpler, but my goal is not to open the debate comparing our system in Canada to the one in the USA. Politically that is not on the table for a while. Rather, I want there to be more information about what all these plans really mean and cost.

Comments

chao

Thu, 2014-01-16 17:30

Permalink

Catastrophic Plan

Since your existing insurance plan got cancelled, you should qualify for a hardship exemption regardless of income level or age. Your graphs show that the catastrophic plan is even better than the bronze at all levels of expenditure. Are you considering applying for that? http://marketplace.cms.gov/getofficialresources/publications-and-articles/hardship-exemption.pdf

brad

Thu, 2014-01-16 23:21

Permalink

Hardship test

I must consider the other plans unaffordable to meet this test, though I don't know how they measure that term. I think they are all too expensive, but I have the money if there is no other choice.

Here the simple slopes of my chart also need more work. Though the main difference between the catastrophic and the Bronze is that the Bronze has a $5,000 deductable and then has copays and coinsurance from there up to the $6,350 MOOP. The minimum/catastrophic plan just has the MOOP -- everything is up to you until then, except for 3 free doctor visits.

(Oddly on the Bronze your first 3 visits are $60 copay, but on the Catastrophic they are free!) Some Bronze plans I have seen offer a $19 copay for generic meds, rather than making them part of your deductable. At least if you meet the hardship rule, it seems. The site shows it both ways.

chao

Sun, 2014-01-19 16:50

Permalink

I think they've

I think they've intentionally left "unaffordable" ill defined for political reasons, but I took to mean that you can self-declare if they are affordable or not.

Daublin

Fri, 2014-01-17 05:34

Permalink

surprisingly low caps

Looking at your graph, I am surprised at how low the caps are. They are in the vicinity of $10k-$16k, and I presume you included the premiums in those amounts. Are you sure you have that right? Intiuitively, I think of the 1/100 bad scenario as being worse than that, e.g. something where you'd move to a smaller home. The 1/1000 scenario would have you reducing your lifestyle. Compared to such scenarios, paying $10k extra in medical expenses is--while admittedly painful--unlikely to lead to any major adjustments to anyone that has a professional job. It's not enough of a cost that, for example, you would overcome your pride and pass the hat around your community for help covering the costs.

On a related note, I agree how strange it is that the bronze and catestrophic plans are clearly the best for people on a middle-class income. As such, we can see that the names of these plans are... let us just say, politicized.

Phillip Helbig

Fri, 2014-01-17 10:31

Permalink

That's the point

"Intiuitively, I think of the 1/100 bad scenario as being worse than that, e.g. something where you'd move to a smaller home. The 1/1000 scenario would have you reducing your lifestyle. Compared to such scenarios, paying $10k extra in medical expenses is--while admittedly painful--unlikely to lead to any major adjustments to anyone that has a professional job. It's not enough of a cost that, for example, you would overcome your pride and pass the hat around your community for help covering the costs."

That's the point of affordable health care. The whole point is that sick people don't have to sell their house, pass around a hat etc.

At first I thought that Brad's graphs should go farther than $39,000, since some illnesses can cost much, much more, but there is no point, since by the time that amount is reached they have all levelled off.

Obamacare is a watered-down compromise version of his original plan, and his original plan was way behind what is common in many countries (and even these are not perfect). Still, it is much better than the situation before. Yes, some rich healthy people might have to pay more. That's a small price for a humane society.

Frank Ch. Eigler

Fri, 2014-01-17 11:00

Permalink

suspicious conclusion

"Yes, some rich healthy people might have to pay more. That's a small price for a humane society."

You missed the part where Brad himself, and really a gajillion other middle-classers, will have to pay more. That's not a small price. And the result, depending on how the health care industry ends up distorted and decisions central-planned, may not be humane either.

Phillip Helbig

Fri, 2014-01-17 11:51

Permalink

definition of rich

Yes, Brad might not be rich in the sense that he earns way below the mean salary, but this is jacked up by very few people who earn very much. Brad probably earns well above the median, i.e. there are many more people who earn less than he does than there are who earn more than he does. He also said that he could afford it. Where's the problem? If you criticize any change which leads to anyone paying more, then you'll never get anywhere at all.

The Revealing

Fri, 2014-01-17 08:35

Permalink

Obama Cares?

Is it possible that The Affordable Health Care Act was never designed to be affordable? Is there more to this story... aka Smart-chip... aka 666, The Mark of the Beast? Was the 3rd Reich a trial run, and the 4th has now begun?;

http://www.focusonrecovery.net/hijackofamerica/Bohemiangrove.html

(arl

Sat, 2014-01-18 13:30

Permalink

Fundamental reason US disease-care avoids cheap prevention

Excellent article, Brad! Many thanks. Will find it useful I think.

Wanted to add one observation about what the health industry SHOULD be doing and why it is not.

Right now people who reach age 65 alive, depend on the govt subsidized Medicare for health care. The private system's job is to keep them from spending money on health care until they become the Govt's problem.

If you leased a car, and were allowed to return it "in any condition", would you even change the oil? A health insurance company turns you over to the government at age 65 for free, regardless of whether they tried to prevent future costs.

When the govt agrees to discharge the private insurance company's responsibility, by taking people in to Medicare, in any condition, at age 65, they are in effect offering a huge subsidy to the private insurance industry. This Government Takeover of patients prevents the insurance industry from feeling the pain of their neglected customers.

The cheapest and best health care system would minimize costs over our whole life, and maximize enjoyment of our healthful years.

o You would see more subsidies for gymnasiums and individual and team sporting events, and less for drugs.

o You would see more check-ups, and government investment for the development and deployment of health monitoring devices, such as FitBit or the Nike watchband.

o CrossFit might be free and operated by the Dept of Health and Human Services.

o The dept of Agriculture would be shut down and a Dept of Food created to insure a reliable supply of healthy foods.

Prevention is way cheaper than cardiac surgery or even drugs to control blood lipids, so a rational government would move money from disease care to health care.

But that won't happen unless the pre 65 insurance business feels the pain of turning over unnecessarily sick people to the government.

Another reason health insurance companies don't care about your future health is that most people change companies every few years even before they are 65.

A rational health care plan would generate health.

A "single payer" system does create the right incentive by eliminating both the age 65 government takeover, and the company-switching problems. But if we put our thinking caps on, we could engineer a system more like what we have, that would still help the insurance companies "feel the pain" from the damage they do. We don't have shift all the costs to get them to provide a lot more disease prevention.

The govt could give health insurance companies an outright subsidy based on the health of the customers they are sending to medicare. Or a penalty... Private insurance could share a fraction of the cost burden of new medicare customers. Medicare could start covering part of the costs of patients before at 60 and ramp up to full coverage by 75.

Single payer is simpler, and I'm all for pushing for it. But that doesn't mean we shouldn't think hard about diagnosing our broken system, and imagining more politically feasible ways to improve it substantially.

----

People want to feel like they are 20, and live forever. This should be our goal!

The drug industry wants you to feel like the average 70 year old, and live forever. (20 year olds don't buy enough prescription meds!)

The insurance companies want you to think you are 20, until you get to be 65 and discover it wasn't true, too late to get any money out of them!

brad

Sat, 2014-01-18 13:53

Permalink

An interesting thought

Since single payer is not politically on the table in the US for a while, other solutions must be proposed. If you put a burden on the insurers for what happens after 65 we would get different behaviour from them. It might make them afraid of having such customers in their 50s and 60s -- and how do you apportion the cost to the company who insured me at 50 vs. the one who insured me at 60? You can't easily force lifestyle changes, it's interesting to see whether insurance companies could push them by charging more if you don't exercise -- how do you enforce that?

Some countries pay doctors for wellness, ie. they say, "You have 500 patients and you get a fixed fee for their general health, though extraordinary illness is covered externally." That makes the doctors motivated to keep you well. (But also to not spend much time with you since they are paid the same no matter how long they see you.) It's tricky. Doctors don't want to take risk for you. They don't want to be the one to pay for it if you get kidney stones no matter how much they told you to alter your diet.

Tony Demetriou

Sun, 2014-01-19 17:43

Permalink

Lifestyle changes *are*

Lifestyle changes *are* hard, and can't easily be forced.

But I think most of us want to make those lifestyle changes, but don't due to laziness, lack of time, lack of organization, etc.

Assuming finances weren't at issue, I'd love to have:

- A gym membership. There's a gym in easy walking distance from my office that I used to go at lunch hour. I had a year's membership, and used it, but then I stopped going for a while. I didn't renew the membership, because I don't want to pay so much in case I only use it for a few weeks. If that membership was already paid for, or cheap enough, I'd have gone a few times. And once you start going to the gym, that's the big difficulty - continuing to go is a lot easier.

- Convenient healthy food options. There are only a few bland, healthy options available unless I bring my own food. And the healthy options often cost more. Food vouchers or a "membership discount" if I scan my insurance card could at least make the healthy meals cost the same as the unhealthy meals.

- Pre-prepared/delivered food. I'd *love* to be able to order delivered food, and have something similar to a home-cooked meal arrive. I'm not talking anything special, just pasta and sauce, or a roast with a side of vegetables, or whatever. When I can't be bothered cooking, my choices are things like pizza, burgers etc. - sometimes I want that junk food, but more often I want the convenience. It'd be nice to be able to have the convenience without the junk. In fact, I'd happily "subscribe" to a service like that, which can bring a random meal to my house every evening between 6:30 and 8pm - with an online webpage so I can check the menu beforehand (to explicitly tell it "don't deliver on Wednesday" either because I'm out, or because I don't like the scheduled meal) - that way they can get some economies of scale. - there are societies that don't bother building kitchens, because restaurant food is so convenient and reasonably priced, and there's a restaurant on every corner. If there was some big national push, it wouldn't be impossible to have "healthy" restaurants with reasonable pricing within walking distance of most people.

- Workplace incentives. I used to go to the gym, but I could do that because our lunch break is an hour long, and the place is fairly relaxed about when exactly you leave and return. We also have bike lockers and showers, which meant I used to ride my bike to work. And regular newsletters reminding us about these things, and encouraging us to use them (we have "ride to work day" twice a year, to encourage the non-bike-riders to try it)

- Social sports and events. I hate organized sports, but that's just me. At our local park there's a group that meets each weekend to play cricket, and passers-by often join in. If there were organized events like that, with explicit invitations, then we'd probably get a lot more people out doing exercise and socializing. And once set up, the groups would probably be able to manage themselves.

The lifestyle changes are hard, yes. But that's more reason to look for ways to encourage them. We don't have to force people to change. If we can remove the barriers stopping them from changing, then we're helping the ones who want the help.

And I'm sure the insurance companies can negotiate a discounted rate for gym membership etc. based on how many people actually take advantage of it, and how often. They wouldn't be paying for a full membership for every member if only 5% of them use it.

brad

Mon, 2014-01-20 11:24

Permalink

The gym idea is interesting

Combining gym membership (or perhaps subsidy of home equipment) with health insurance is an interesting idea. People are notorious for joining gyms and then not going very much. In fact, that's how a lot of gyms make their money, on all the people who pay and don't go. Gyms need to be convenient to get used. "Drive 15 minutes, change, work-out, shower, change, drive 15 minutes" discourages lots of people. Home equipment saves a huge amount of time for those who use it just before they were going to shower anyway, before they even get dressed in the day's clothes. But if now-compulsory health insurance did a lot to encourage exercise it might help a lot.

On the healthy food front -- I have a future article coming, but robocars are going to change this a lot. Cheap delivery of any kind of food, any time, made to order or specialized to particular dietary demands. A dietary preference that's too minor to get a lot of attention in your neighbourhood can suddenly become practical.

Phillip Helbig

Mon, 2014-01-20 03:36

Permalink

additional problem

Although Obamacare will help some of the uninsured, it doesn't tackle the problem that health care in the US is simply too expensive. The same quality care is provided elsewhere at much less cost. An interesting aspect of this is that the US can claim to spend a large sum per capita on health care, but that doesn't necessarily translate to buying a lot of good health care per capita.

brad

Mon, 2014-01-20 11:25

Permalink

The cost

Yes, though that huge political fight is over, and it is what it is. The question is, how to make the best of the current constraints, until such time as they can be redebated.

DensityDuck

Mon, 2014-01-20 11:29

Permalink

Psychology of healthcare coverage

The issue is that people won't look at Bronze coverage as "well, it's lower overall". They'd look at it as "every time I go to the doctor I gotta pay!" They don't think, if they go in with a Gold plan, "well of course I'm getting this for free, I pay for it every time I get my paycheck".

This is because people don't "see" the regular deductions from their paychecks. They *do* see unexpected deductions from their bank account"

(which is, also, why people always have this idea that their taxes are really low. Because, for most of them, taxes are also paid through automatic deduction. They don't think of themselves as getting, say, $800 and then the government takes away $250; they just see a check for $550 and think "okay, I make $550 a week".)

Becca

Thu, 2014-01-23 12:54

Permalink

Maternity

If a 25-year-old or 30-year-old Californian is planning on having a child in the next year, Platinum looks like the way to go, assuming there aren't weird exclusions. (It used to be that certain health plans didn't cover maternity care at all.)

brad

Thu, 2014-01-23 14:55

Permalink

Maternity is easy to calculate

Turns out that for most plans (perhaps it is required) the marketplace web sites will actually outline the different costs of a typical birth on the different plans, so that's something you can analyse directly. They also lay out the cost of a year of care for a typical type II diabetic.

Ed

Wed, 2014-03-05 19:01

Permalink

Uninsured often pay LESS than negotiated rates

In my experience being uninsured for many years... You typically pay from 15 to 80% less if you're not insured for the same procedures. One particular MRI was $3000 with insurance, or $350 via AmEx. That's extreme, and 25% less is probably typical.

brad

Wed, 2014-03-05 20:05

Permalink

Say more

There are reports of it going in both directions. Of people saying up front, "I don't have insurance" and getting a good rate, and others (especially those who don't negotiate it up front) getting billed for huge rack rates.

I do know that the negotiated rate at the medical facilities I go to is usually as low as 1/4 the rack rate.

Edward

Tue, 2014-11-25 20:02

Permalink

Nice charts to explain this

In the fall of 2013, our insurance was also canceled. I created a spreadsheet model, similar to what you did, but never drew the nice charts - except to illustrate the idea of how maximum out of pocket limits changes everything. I created the model because we had to pick our own plan, plus I was trying to assist our married daughter, who also had to buy a plan in another state.

I came to the same conclusions as you - for most people, the bronze plan is the best value, even though this is counterintuitive. This is especially true for someone with few expected expenses and, surprisingly, for someone with huge expenses. As you note, there are some "windows" between few and huge expenses where other alternatives may make sense (my conclusion too).

Like you, I also wondered why this spreadsheet model was not widely available to all consumers.

This year (2014, looking at 2015) plans, I am struck by the narrow difference between the price of the bronze plans and the price of the gold plan in my zip code. For most insurers, the bronze/silver plans, for our family scenario, run $800 to $900, but the gold plans start at $1100 or so (and go up to about $1450/month). That is a remarkably narrow pricing range between the bottom and the potential low end of the gold plans. Since the bronze plans are perceived as delivering few benefits (they are mostly catastrophic coverage), the narrow pricing difference suggests many consumers will buy up to the gold (or similar plan) for perceived greater benefits. That is likely to be a bad choice for many consumers, but its great for the insurance companies when consumers over buy and then have few expenses.

Thank you for your analysis

Edward, Oregon

Jessn

Wed, 2015-04-01 16:32

Permalink

Thanks for charts!

Just commenting to say thanks for posting this.

I feel like I’m the crazy one, reading article after article advising people to choose a plan (bronze ---> platinum) based on their expected health care outlays (low ---> high), when the out of pocket maximum completely changes all that. It looks like it's been a year since you posted this and it still is not how people are talking/thinking about these premium choices.

Anonymous

Sat, 2016-09-17 17:31

Permalink

Still Relevant in 2016 - Let's see what 2017 holds.

Brad, came to your blog by way of Real Clear Future article you had on Economics of Self Driving. I had much the same intuition as your conclusion there, only hadn't worked out the figures to prove it like you have. Good job!

Then surfed your site and found this analysis of Obamacare.

Have done a similar analysis myself for the past several years and concluded it was foolish to go for anything more than Bronze. If we don't have to out of pocket, we save (and have), and if we hit some health emergency, then we know our max out of pocket.

Still, that is not the end of it. We did get hit with "balanced billing" one year when our daughter hit the emergency room of an "in-network" hospital. It seems the doctors on staff may be "out of network". So, even if you do be careful to make the best economic decision, you can end up paying more than you thought you'd be, and you have absolutely no control over it.

As I learned, even major medical procedures are fraught with these "gotchas".

Rather than Obamacare, would much rather have legislation that made medical services post their "all in" charges, so I can shop around based on both reputation and cost.

Andrew Palmer

Wed, 2016-10-26 16:46

Permalink

Bronze

Great article, am switching from Silver to Bronze. Why are us Americans so stupid in regards a public option?? Ask anyone in Canada or Britain or Germany or France or Norway or etc etc etc if they will ever give up public option healthcare... the answer is a firm NO!!!

Walt19

Thu, 2016-11-03 21:43

Permalink

Obamacare-contd

I woke up a little late to the Bronze hypothesis. It just hit me and I started googling it, and found your elegant analysis.There were a surprisingly few voices pointing out that Bronze may be best for all. Is it time to reopen this interesting discussion about Obamacare? I have no political agenda but suddenly find myself in my 60's, and it doesn't take much to be ineligible for tax credits, but be on the hook for $1600-1800 in California for a B or S plan. As you have pointed out, there is a sizable minority in this situation, and it is a lazy press that merely reinforces the party line that the"vast majority" of people are eligible for credits.Who knows how high premiums will be going up for pre Medicare age patients before the government saves them. The irony in California is that Medicaid payments to doctors are the second lowest in the country, so there aren't enough doctors to go round, and those that stay in the system, almost by definition, are not top quality. The hospitals make out like bandits, getting Federal money. It seems clear that some older folks, who have been keeping the insurance companies fat and happy during their most productive years, will end up either paying the Obamacare penalty, or skimping on their out of pocket services. Since this all started, the networks and formularies have contracted, and for most generic drugs, you are better off paying cash at Costco or Walmart, than using your drug plan. Moreover, you can negotiate a cash price for an MRI for less than the copay(plus your deductible amount, most likely)of a Silver plan.

Just saying...

Anonymous

Mon, 2016-12-12 22:29

Permalink

Still Relevant in 2017, Even w Shared Cost Reduction on Silver

Calculated once again.

Folks can figure it out for themselves, but will need a spreadsheet to keep score, and run through three scenarios of Low, Medium and High expected medical costs for ALL family members (the website let's one choose, but it is a pain to go back and forth on it), using the resulting total ANNUAL cost of each plan they are comparing (in tiny print about halfway down the side by side comparison of up to three plans).

HOWEVER, this year ACA is pushing the Silver plans with "Extra Savings".

Evidently, only for Silver plans, there is a SECOND subsidy available for some. It is the Shared Cost Reduction Subsidy for out of pocket expenditures. It is based on the percentage of the Federal Poverty Level (FPL). More here:

https://www.healthinsurance.org/obamacare/the-acas-cost-sharing-subsidies/

Silver plans normally have a 70% coverage (aka a 70% actuarial value - btw, Bronze is 60% coverage). But, that 70% can be bumped up to 73%, 87%, 94%, in Silver plans, at 200% FPL, 150% FPL, and 100% FPL, respectively.

Used the kaiser foundation subsidy calculator (it was slightly off, but added $50 subsidy at each FPL level) to figure out the combined net after subsidy premium and net after subsidy oop expenditures.

http://kff.org/interactive/subsidy-calculator/

In the plans I had access to, same vendor, at the 100% FPL, only one Silver plan did better than any Bronze plan, and that was only where all family members were High expected costs. But that effectively means a $17K total expenditure on a $20K income. Unless they KNEW they had big medical expenses coming, seems folks in this income level would opt for Bronze, at half the premiums, or quit work and go on Medicare.

Similar story at 150% FPL - one Silver plan outperforms all Bronze plans, and one other Silver Plan is close to even with the optimal Bronze plan, BUT, again, only at ALL High expenditures for family members.

Since the Silver and higher plans have roughly the same Max OOP, there is not much upside to paying their higher premium. The premium is what you guarantee will come out of your pocket, but the rest is what "might" come out of your pocket.

Perhaps, depending on the mix of doctors visits, tests, drugs, etc, and your age, if your use is reasonably predictable ahead of time, maybe a given Silver plan may make some sense.

But, who other than the most ill know all this?

The rest of us are best off with the cheapest Bronze, AFAI Can Tell.

Leaves me scratching my head as to why offer the others at all. Maybe most people don't bother to figure this out, and impute more value based on perceptions of the "metal" category. With such heavy government involvement, it cannot all be attributed to "marketing".

007

Sun, 2017-01-01 11:13

Permalink

Your blog has helped me to

Your blog has helped me to understand medical health insurance. Thank you. I would like to share with all readers a potential solution to finding a lower price health insurance plan - enroll in a part time degree in a university where an affordable policy is offered. The plans are national and cover young people so average risk profile is lower, hence lower premium and deductible. As I understand, Obamacare ensured the following: (i) all basic health services and procedures are offered in any and all plans, so the differences among policies are insignificant. Key distinction among plans are the doctors covered in-network so ensure your doctors and hospitals are covered (ii) no ceiling on costs when you need care (iii) no pre-existing conditions exclusion. Good luck.

Josh Lane

Fri, 2017-02-03 07:22

Permalink

Curious to see the future

I'm curious to see what's going to happen now that the GOP controls every level of government. I can't imagine cutting insurance coverage to millions of people is a great idea politically, especially when they're likely to have their backs against the wall in the midterms. The best idea has to be to try and figure a way to make it cheaper for the average person.

Phillip Helbig

Fri, 2017-02-03 07:56

Permalink

trust Trump to do it

Sure it's a bad idea---like the rest of Trump's programme. That is one reason we can be sure that he'll do it. After all, only immigrants and commies signed up for Obamacare, right? Real men don't get sick because they don't eat quiche. And if they do, the pay for it themselves, through honest work. Trump knows a lot about that. That's why he won.

MarkD

Fri, 2017-12-08 07:34

Permalink

2-person family plan

Hi, can someone please explain how it can cost more to have 2 persons on a family plan vs on 2 identical individual plans? Brad wrote: “So if you have two people, and one is healthy and the other hits the deductible or MOOP limits, you will pay a lot more.”

brad

Fri, 2017-12-08 12:04

Permalink

The MOOP

With the family plans for a couple, the MOOP is double the single plan MOOP. So if the single MOOP is $7K the family is $14K. So if one person needs $13K of expenses and the other $1K, under two single plans, they would pay $8K. Under the family plan they would pay $14K! So no way get the family plan for just two. Once you add some kids, it becomes more reasonable, not on the MOOP but on other things.

MarkD

Fri, 2017-12-08 15:13

Permalink

2-person family plan and the MOOP

Thanks for your explanation, Brad, but I still don't get it. If get a plan with a family MOOP is $14K, it's generally the case that the individual MOOP is half that, i.e., $7K. So if one person needs $13K of expenses, they would hit the $7K MOOP, and so they'd only pay that $7K. If the other person needed only $1K, then they would pay it all out. So, you get the same total.

The quote for a bronze plan I'm looking at now for example is: MOOP for Individual plan: $6,550; MOOP for Family coverage: $6,550: individual $13,100: family.

Their explanation:

- Family coverage has an individual OOPM within the family OOPM. This

means that the OOPM will be met for an individual who meets the

individual OOPM prior to the family meeting the family OOPM within a

Calendar Year.

So I don't really see a way you can pay more with a family plan vs. 2 individuals. I think you'd just pay the same, not less, but not more.

brad

Fri, 2017-12-08 22:48

Permalink

That's better

When I wrote this it appeared the family MOOP was the only one, and you did not get an individual sub-moop. If you do, then it's better.

MarkD

Sat, 2017-12-09 15:10

Permalink

2-person family plan issue went away in 2016

Brad, I think I figured out that when the article was originally written in 2014, a 2-person family plan could be worse than 2 individual plans, but they fixed this in 2016.

See: https://www.shrm.org/resourcesandtools/hr-topics/benefits/pages/embedded-oop-limits.aspx

Summary: prevents consumers from being penalized for purchasing family coverage rather than self-only coverage.

Thank you.

Wes

Thu, 2018-11-15 14:53

Permalink

Affordable definition for catastrophic plans

Hi Brad, great analysis. The ACA defines "affordable" as 8.06% of modified AGI. If the lowest cost bronze plan is not "affordable", then you can purchase a catastrophic plan. This saved us (63 and 61 years old) ~$200/month in 2018, and will save $580/month in 2019. You must jump through substantial hoops to even see the catastrophic plan prices on the exchange. You need to fill out a paper form, and MAIL it in with your latest 1040 and a screenshot from the exchange showing the lowest cost bronze plan, and a document from the exchange showing you do not qualify for the tax credit. Form and instructions here: https://www.healthcare.gov/exemption-form-instructions/

Add new comment